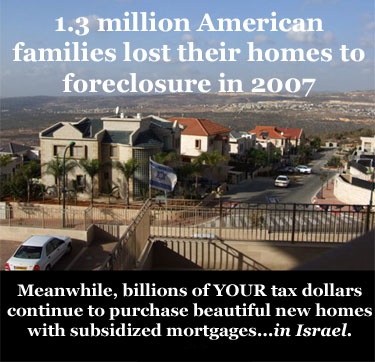

“Families all over the country continue to lose homes in record numbers...” —Michael J Calhoun of the Center for Responsible Lending

In the classic Christmas movie, “IT'S A WONDERFUL LIFE,” we find the humble small town of Bedford Falls, about to lose their homes to a sinister greedy banker, Henry F. Potter. The star character of the movie is George Bailey (played by famous actor James Stewart). In the early part of the movie, George Bailey attempts suicide, but is saved by his watchful guardian angel, Clarence. George states that he wishes he had never been born. So Clarence grants his wish, and then shows George Bailey what Bedford Falls would have actually been like, had he never been born. As a consequence, Bedford Falls is renamed to “Pottersville,” named after the evil banker who stole it.

Long story short, George decides to live after all and is returned to his earthly life. We find George Bailey at the bank, trying to ward off a run on the banks. The townspeople want their money, but George doesn't have it. He says something like... "Joe, your money is invested in Fred's home. And Charlie, your money went to build Stan's home. And so forth." I can't think of a better example of the dangers of the Fractional-Reserve Banking System (aka, the Federal Reserve Bank), than the movie It's A Wonderful Life. What we see happening in America today is Pottersville. Where is George Bailey when we need him? Millions of people are losing their homes because of the greedy evil bankers. Today's housing market is a fulfillment of Bedford Fall's worst nightmare. They have all lost their homes and town to the bankers.

It is actually a dark, bittersweet post-war tale of a savings-and-loan manager who struggles against a greedy banker and his own self-doubting nature in a small town. Earnest do-gooder George Bailey (James Stewart) recognizes his life as wonderful and truly rich, even in its humdrum and bleak nature, only after suffering many hardships, mishaps and fateful trials (including compromised dreams of youth to leave the town and seek fame and fortune, other sacrifices, dismay, losses and the threat of financial ruin, and suicide). He is given encouragement by a whimsical, endearing, trainee-angel named Clarence (Henry Travers).

The story turns Dickensian (similar to A Christmas Carol, although told from Bob Cratchit's point-of-view rather than from Scrooge's) when the hysterical, despairing, and melancholy family man is shown what the small town (Bedford Falls, now renamed Pottersville after the town's evil tycoon) would be like without him. It's a frightening, nightmarish, noirish view of the world (at Christmas-time) that brings him back from self-destruction. He returns to the idyllic, small-town world that he left, with renewed faith and confidence in life itself. Hence, the film's title: It's a Wonderful Life.

SOURCE: It's A Wonderful Life (1946)

In reality, it's a wonderful life for the greedy bankers, at the expense of your home and property.

When hurricane Katrina hit New Orleans in 2005, many people thought God was judging America. I think not. If God were going to destroy America with nature, He'd start in Las Vegas, Hollywood and The White House. The truth is that we as a nation have brought judgment upon ourselves in many ways, through our complacency and ignorance, and now it is being seen in the housing market. God will not be mocked... "sin is a reproach to any people" (Proverb 14:34). Sin causes people not to care. As a result, Communists in the U.S. have been able to kick God out of the public school system, make abortion legal, legitimatize homosexuality, and continue bankrupting America through the Federal Reserve scam. The average American is woeful ignorant of the truth, and even worse, doesn't care.

Psalm 11:3, "If the foundations be destroyed, what can the righteous do?" The Bible speaks about the fool who built his house upon the sand... Luke 6:49, "But he that heareth, and doeth not, is like a man that without a foundation built an house upon the earth; against which the stream did beat vehemently, and immediately it fell; and the ruin of that house was great." Today's homebuyers have been duped by the demonic Federal Reserve Scam. America's money, stock market, and economy are all built upon a foundation of SAND. There is little if any intrinsic value. This is why the U.S. dollar has lost 37% of it's value since 2001. America's economy is a house of cards, ready to crumble.

Over 40,000,000 Americans are now receiving government Food Stamps... welfare (as of 2010). The more money the Federal Reserve prints, the less it's worth. Don't be fooled for a second, George W. Bush was no friend to the American people, and neither is President Barack Obama. Our government is in bed fornicating with the criminal banking cartel. This evil all began on Jekyll Island, Georgia, in 1913. To learn the truth, listen to G. Edward Griffin's THE CREATURE FROM JEKYLL ISLAND, and prepare to get angry. This is why you're losing your home. —by David J. Stewart

To

add insult to injury, our government leaders have deliberately left the

Mexican-American

To

add insult to injury, our government leaders have deliberately left the

Mexican-American

THE

SUB-PRIME CRISIS IN CLEVELAND

THE

SUB-PRIME CRISIS IN CLEVELAND

As Americans continue to rebel against God's

Word—embracing homosexuality, the lies of evolution, Harry Potter's

witchcraft, feminism, divorce, booze, dirty dancing, Hollywood movies, Rock

'N' Roll, fornication, abortion, covetousness, indifference, greed, pornography,

adultery, casino gambling, prostitution,

covetousness, and sinful pride—we are bringing judgment upon ourselves! Our nation is falling apart! The truth is that most Americans have lost

their moral integrity, and thus their desire for truth and justice. I

have never seen so much dishonesty in business as I do today, and greedy

company policies intended to gouge the consumer at every opportunity! The

Word of God teaches to “Love thy neighbour as thyself,” not take advantage

of others. Americans are among the worst offenders!

As Americans continue to rebel against God's

Word—embracing homosexuality, the lies of evolution, Harry Potter's

witchcraft, feminism, divorce, booze, dirty dancing, Hollywood movies, Rock

'N' Roll, fornication, abortion, covetousness, indifference, greed, pornography,

adultery, casino gambling, prostitution,

covetousness, and sinful pride—we are bringing judgment upon ourselves! Our nation is falling apart! The truth is that most Americans have lost

their moral integrity, and thus their desire for truth and justice. I

have never seen so much dishonesty in business as I do today, and greedy

company policies intended to gouge the consumer at every opportunity! The

Word of God teaches to “Love thy neighbour as thyself,” not take advantage

of others. Americans are among the worst offenders!  The government is spending recklessly with

money borrowed in OUR name from the Federal Reserve (which is not federal

and has no reserve). As more money is borrowed (i.e., printed out of

thin air), it dilutes the value of the money already circulating in the

economy. Just as adding water to soup dilutes it, so does printing

more money dilute the economy and raise inflation (i.e., the cost of

living). Think about this—the government gets to spend the money it prints when it

is initially still at its top dollar value, BUT by the time the money hits

the economy (thus diluting it), it has been reduced in value. In other

words, the American people are the big losers every time the government

borrows more money. The more money they borrow (print), the less our

currency is worth in purchasing power. Ultimately, America will go

completely bankrupt! This fraudulent system is designed to keep you working

all your life, as a hamster running on a wheel, never able to save an

inheritance to leave your children, and then you die broke! THEY DECIDE what

you will own (or not own), and no amount of honest labor will make a

difference, they will take it all!

The government is spending recklessly with

money borrowed in OUR name from the Federal Reserve (which is not federal

and has no reserve). As more money is borrowed (i.e., printed out of

thin air), it dilutes the value of the money already circulating in the

economy. Just as adding water to soup dilutes it, so does printing

more money dilute the economy and raise inflation (i.e., the cost of

living). Think about this—the government gets to spend the money it prints when it

is initially still at its top dollar value, BUT by the time the money hits

the economy (thus diluting it), it has been reduced in value. In other

words, the American people are the big losers every time the government

borrows more money. The more money they borrow (print), the less our

currency is worth in purchasing power. Ultimately, America will go

completely bankrupt! This fraudulent system is designed to keep you working

all your life, as a hamster running on a wheel, never able to save an

inheritance to leave your children, and then you die broke! THEY DECIDE what

you will own (or not own), and no amount of honest labor will make a

difference, they will take it all!